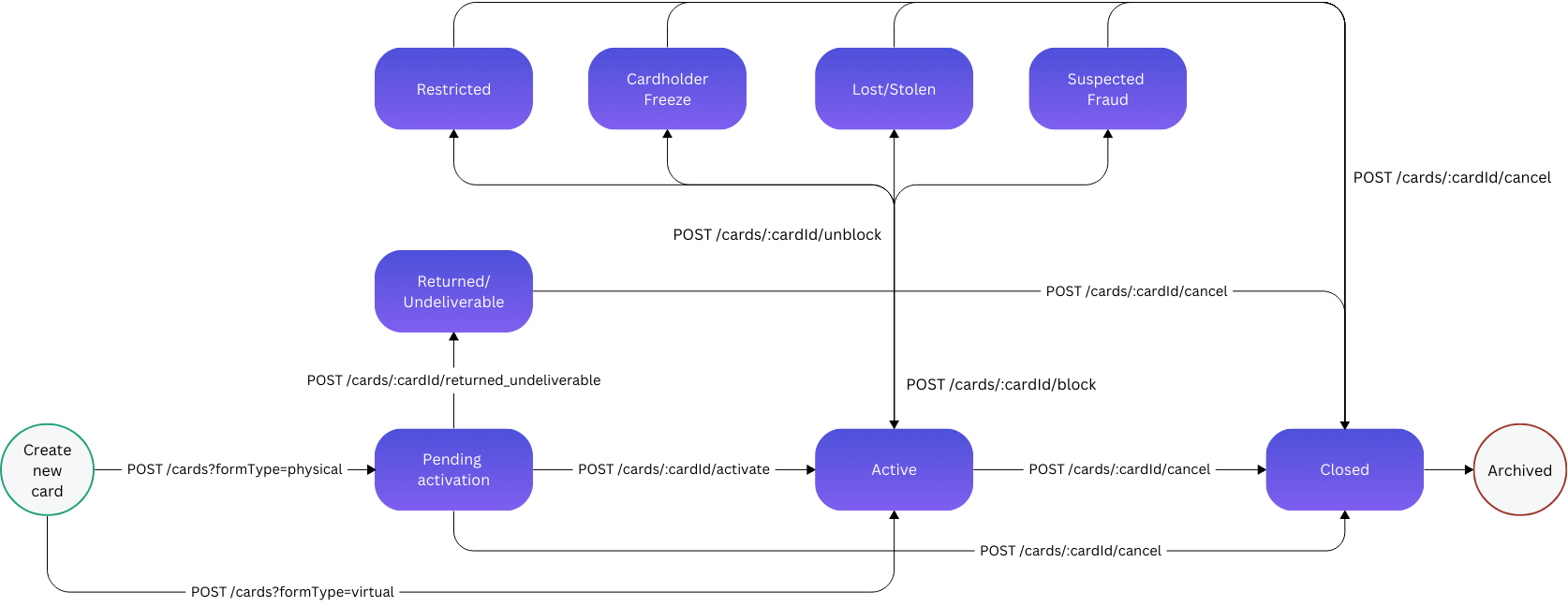

Card Management

Card management plays a vital role in the debit card program offered by Interlace, providing essential functionalities to ensure the security and usability of the card. The main functions include:

- Create a Card:This function allows a new card to be issued when there is currently no active card on the account and the account is eligible for debit cards.

- Activating the Card:This function allows the cardholder to activate their new debit card on Interlace, making it ready for use. The activation process typically involves verifying the cardholder’s identity and confirming receipt of the card.

- Blocking the Card: In cases of suspected fraud, Interlace enables the card to be blocked. Blocking the card prevents unauthorized transactions and protects the cardholder’s funds.

- Unblocking the Card: If a card was blocked due to suspected fraud, it can be unblocked once the cardholder confirms there is no fraud.

- Cancel Card: The cancel card function is used to permanently close a card.

- Reissue/Replace: This function allows a cardholder to request a new card. A card reissue is executed on cards coming up to expire or if the card is damaged. A card replacement is for cases where the previous card needs to be permanently closed and a new card needs to be issued.

- Freeze/Unfreeze Card Control: Enable the cardholder with the ability to freeze and unfreeze their card at will.

- Mark card as Undelivered: When a card is returned in the mail, this API allows the party responsible for processing the returned mail to mark the card as undelivered.

- Increasing Daily Limits: Cardholders may need to increase their daily spending or withdrawal limits. Interlace allows them to request and set higher limits, subject to approval and verification processes.

Reference our Card Management APIs for more information.

Card Lifecycle